DGFT: Relief for Exporters under the EPCG Scheme

DGFT: Relief for Exporters under the EPCG Scheme (2024-25) The Government of India, through the Directorate General of Foreign Trade (DGFT), has issued Policy Circular

DGFT: Relief for Exporters under the EPCG Scheme (2024-25) The Government of India, through the Directorate General of Foreign Trade (DGFT), has issued Policy Circular

Support for Alternative Trade Instruments intervention under the Export Promotion Mission (EPM) – NIRYAT PROTSAHAN The Government of India has launched the Support for Alternative

The Government of India, through the Directorate General of Foreign Trade (DGFT), has launched the Facilitating Logistics Interventions for Freight & Transport (LIFT) scheme under the NIRYAT DISHA Export Promotion Mission.

The Government of India has launched the Trade Regulations, Accreditation & Compliance Enablement (TRACE) scheme under the Export Promotion Mission (EPM) – NIRYAT DISHA. This initiative is designed to strengthen India’s quality and technical compliance ecosystem, specifically helping MSMEs meet the regulatory requirements of importing countries.

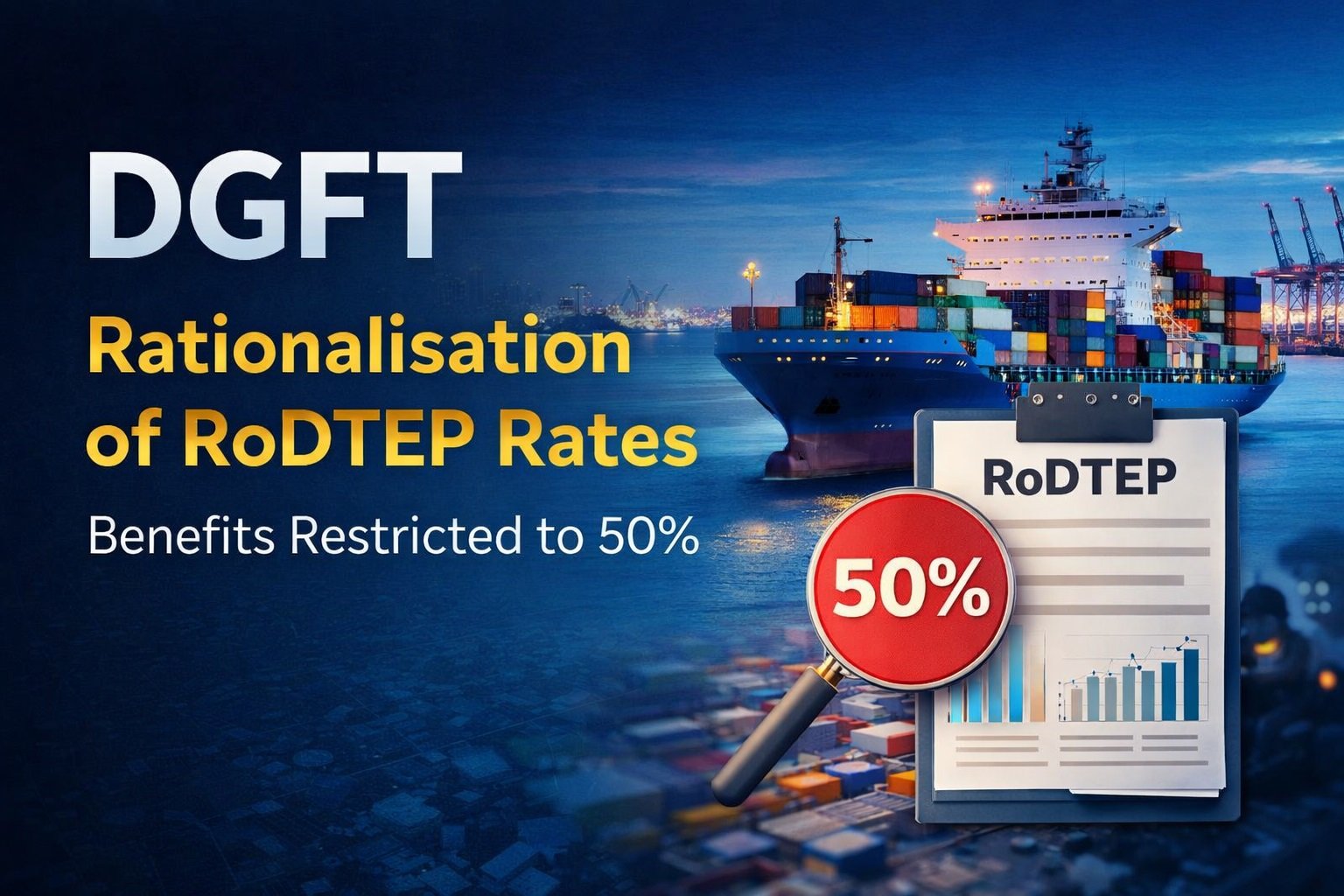

DGFT Rationalises RoDTEP Rates: Incentives Restricted to 50% – Key Policy Shift for Exporters The Directorate General of Foreign Trade (DGFT) has issued Notification No.

CBIC Simplifies GST Registration Process and Restricts Unnecessary Officer Queries The Central Board of Indirect Taxes & Customs (CBIC) has issued Instruction No. 03/2025-GST dated

WhatsApp us