Support for Alternative Trade Instruments intervention under the Export Promotion Mission (EPM) – NIRYAT PROTSAHAN The Government of India has launched the Support for Alternative Trade Instruments intervention under the Export Promotion Mission (EPM) – NIRYAT PROTSAHAN. This initiative is designed to strengthen access to export finance for MSMEs by providing structured support for alternative […]

The Government of India, through the Directorate General of Foreign Trade (DGFT), has launched the Facilitating Logistics Interventions for Freight & Transport (LIFT) scheme under the NIRYAT DISHA Export Promotion Mission.

The Government of India has launched the Trade Regulations, Accreditation & Compliance Enablement (TRACE) scheme under the Export Promotion Mission (EPM) – NIRYAT DISHA. This initiative is designed to strengthen India’s quality and technical compliance ecosystem, specifically helping MSMEs meet the regulatory requirements of importing countries.

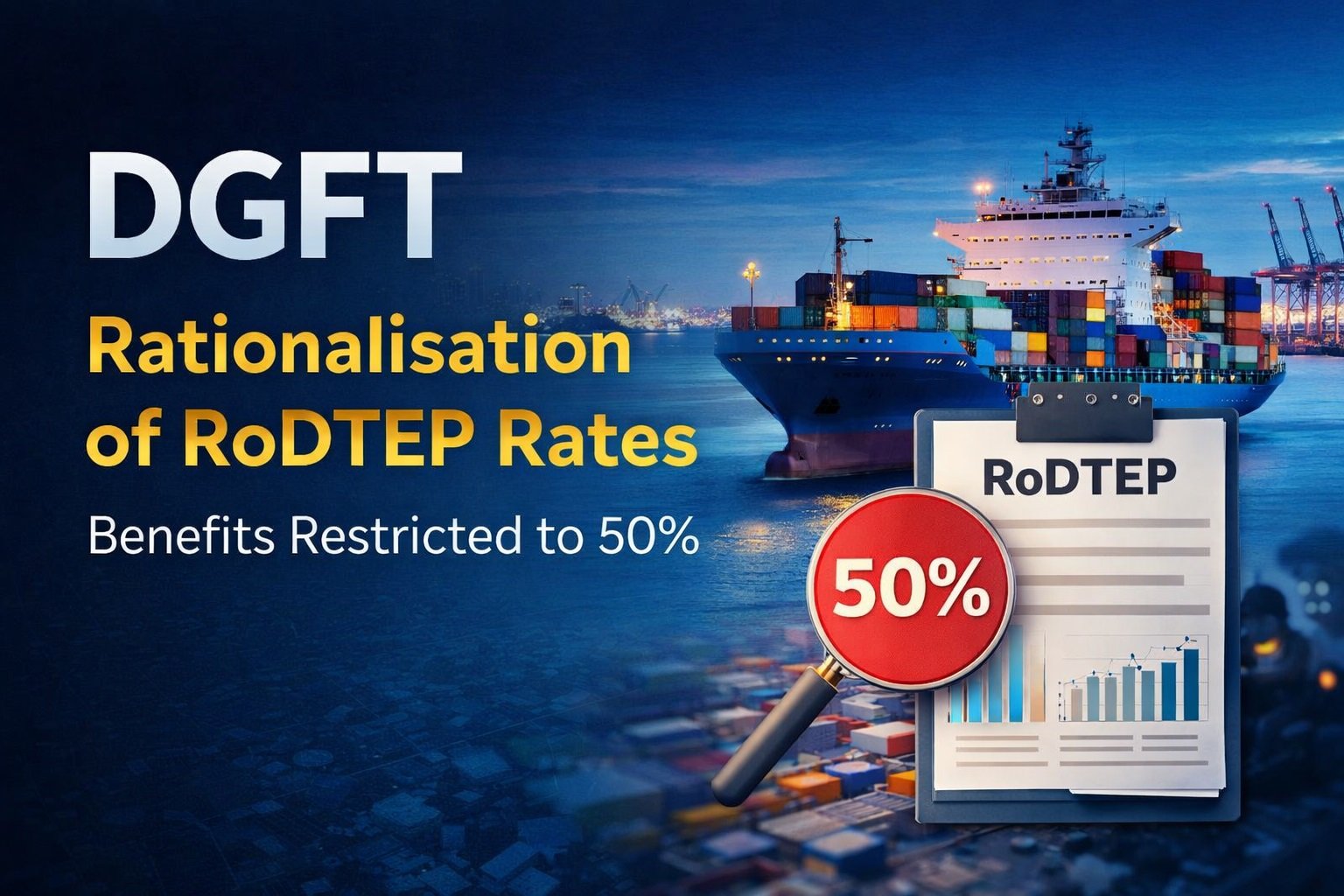

DGFT Rationalises RoDTEP Rates: Incentives Restricted to 50% – Key Policy Shift for Exporters The Directorate General of Foreign Trade (DGFT) has issued Notification No. 60/2025-26 dated 23 February 2026, introducing a significant rationalisation under the Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme. The amendment represents a noteworthy policy recalibration impacting incentive […]

CBIC Simplifies GST Registration Process and Restricts Unnecessary Officer Queries The Central Board of Indirect Taxes & Customs (CBIC) has issued Instruction No. 03/2025-GST dated 17th April 2025, to streamline the process of GST registration and minimize unnecessary queries and document requests by officers. Key points include: Simplified Documentation: Only specified documents listed in FORM […]

New Income Tax Bill Introduced in Lok Sabha New Delhi, February 13, 2025 – The government today introduced the Income Tax Bill 2025, in the Lok Sabha, aiming to bring significant changes to the existing tax framework. Finance Minister Nirmala Sitharaman presented the bill, emphasizing the government’s commitment to simplifying the tax system and promoting […]

Union Cabinet Approves New Income Tax Bill, Set for Lok Sabha Discussion on Monday: Reports New Delhi, Feb 8, 2025 – The Union Cabinet has approved the much-anticipated new Income Tax Bill, paving the way for a major overhaul of the existing tax framework. The bill is expected to be tabled in the Lok Sabha […]

India to Introduce New Income Tax Act, Finance Minister Confirms in Budget 2025 New Delhi, February 1, 2025 — In a landmark announcement during the Union Budget 2025 presentation, Finance Minister Smt. Nirmala Sitharaman confirmed the introduction of a new Income Tax Act, signaling a transformative shift in India’s taxation framework. This reform aims to […]

Key Highlights of Union Budget 2025: Major Reforms in Taxation, MSME Growth, and Export Promotion The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, introduces several key reforms aimed at stimulating economic growth and enhancing the ease of doing business in India. Export Promotion Measures: Duty-Free Inputs for Handicraft and Leather Sectors: To support […]

Opportunity for Taxpayers to Correct Discrepancies in GSTR-3B GSTN provided an opportunity for taxpayers to correct discrepancies in GSTR-3B vide issuing advisory dated 09.04.2024 on Reset and Re-filing of GSTR-3B of some taxpayers. The advisory issued by GSTN is provided below for the taxpayers: Dear Taxpayers, 1. This has reference to the facility for re-filing of […]