GST Registration | GST Registration Process in Hindi | Online GST Registration करना सीखें | If you’re looking to register for GST (Goods and Services Tax) in India, this video is for you. In this tutorial, we’ll go through the step-by-step process of registering for GST. Firstly, you’ll need to have the required documents ready […]

Amnesty EPCG/ Advance Authorisation Scheme Generally goods including capital goods or raw material can be imported on payment of custom duty. However, as per Foreign Trade Policy exporters can import capital goods or raw material without payment of custom duty, if they take EPCG/Advance Authorisation from DGFT, however for taking advantage of duty-free import, it […]

Key Analysis of CGST Notifications issued on 31/03/2023 Recently, Government has issued various notifications to give effect to the recommendations of the GST Council in its 49th Meeting held on 18th February, 2023. Gist of all the notifications is given hereunder: 1. Amnesty schemes for non-filers of return: i. Late Fee reduced/waived on non-filing […]

[slide-anything id=”49809″] Key Highlights: Foreign Trade Policy 2023 Key Highlights: Foreign Trade Policy 2023 Central Government notified the new Foreign Trade Policy 2023, in exercise of powers conferred by section 5 of Foreign Trade (Development and Regulation) Act, 1992 (No. 22 of 1992) [FT (D&R) Act], as amended Directorate General of Foreign Trade (DGFT) […]

Restriction on blocking of ITC Under Rule 86A

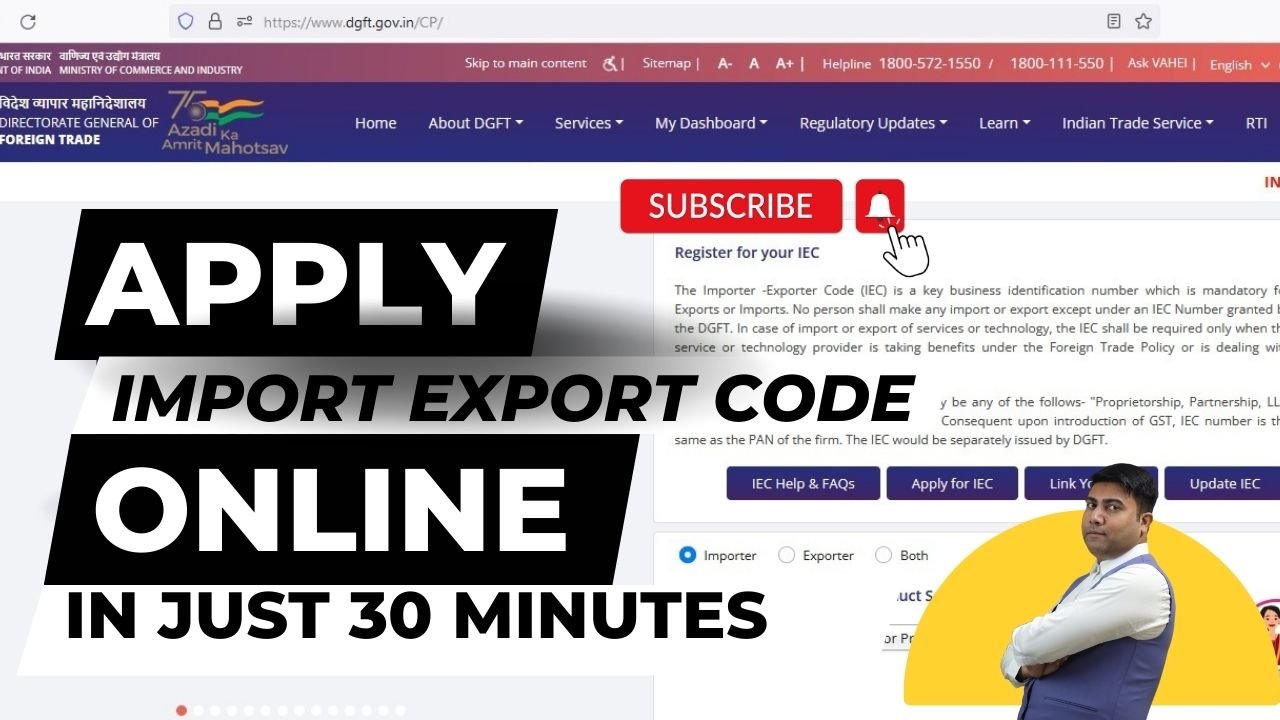

How to apply Import Export Code (IEC): Complete Procedure This Video tutorial on Import Export Procedures describes the complete process to apply the Import Export Code online, by watching the Video users can easily apply the IEC application on Government Portal without paying any additional fee to anyone, to know the documentation requirement for import […]

In any type of businesses, an accountant is needed. You have to consider that accounting is basically the language in business and having enough knowledge about accountancy is essential for businessmen and women to know how their business is doing. This is why accounting professionals are very much in demand today. And, a lot of […]

Finance Minister Nirmala Sitharaman chaired the 49th GST Council meeting today in Delhi with Minister of State for Finance Pankaj Chaudhary, her state counterparts and other senior officers. In the meeting Government of India has decided to clear the entire pending balance GST compensation of Rs. 16,982 crore for June’ 2022 A Gist of the […]