Prior to levy of introduction of GST, several indirect taxes were existing. GST has subsumed a number of indirect taxes being levied by the Centre and State Governments including Central Excise duty, Service Tax, VAT, Purchase Tax, Central Sales Tax, Entry Tax, Local Body Taxes, Octroi, Luxury Tax, etc.

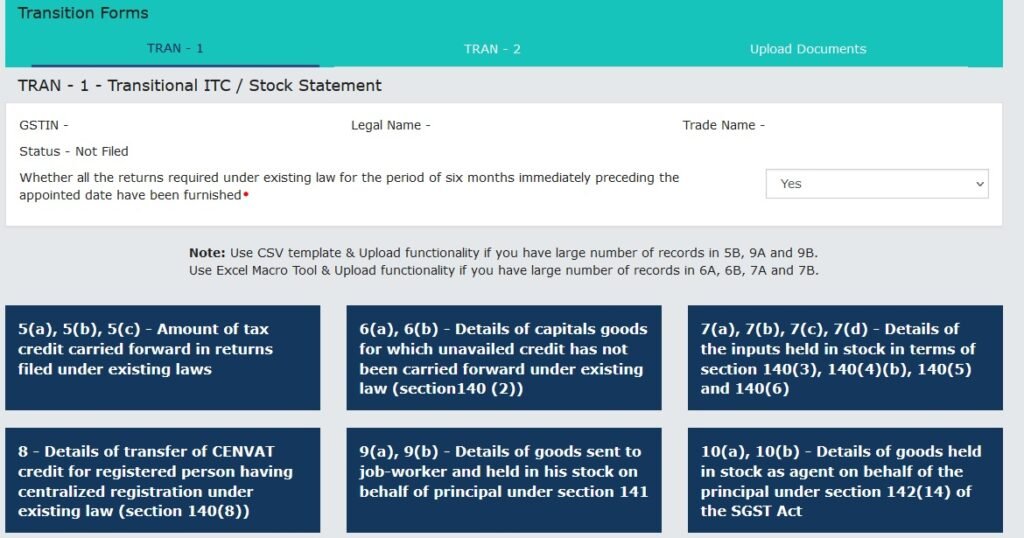

To carry forward pre-GST credits to the GST system, Tran-1 and Tran-2 forms were brought by the government. As per the provisions of GST Law, such forms had to be filed within 90 days (which was further extended till 27.12.2017).

Due to various reasons, some assessees could not file the claims within the stipulated period. The TRAN-1/2 window of GSTIN portal did not allow such assessees to file their claim after due date. Some of the taxpayers had made mistake while filing the TRAN forms, such taxpayers were also unable to revise their claims. Due to such circumstances, such persons have to go before High Courts for issuing directions in this regard. High Courts were flooded with numerous Writs.

Taking cognizance of the said situation, the Hon’ble Supreme Court of India in the case of UOI vs. Filco Trade Centre Pvt. Ltd has directed the Goods and Service Tax Network (GSTN) to reopen the windows of TRANS-1 and TRANS-2 for filing/revising the ITC claim of the taxpayers.

In accordance with the directions of Hon‘ble Supreme Court, GSTN has revived the window for two months to file/revise the TRANS-1/TRANS-2. Now, vide Circular No.180/12/2022-GST dated 09-09-2022, CBIC has issued detailed guidelines for filing/revising the Tran-1/Tran-2 Forms.

- Guidelines given in the Circular No.180/12/2022-GST

- Points to be taken care while filing these forms

- Guidelines given in the Circular No. 180/2022 dated 09-09-2012:

The guidelines given in the Circular No. 180/2012, ibid, are summarized as under:

- Timeline for filing/revising form: The portal shall remail open from 01.10.2022 to 30.11.2022 for filing/revising the claim.

- Uploading of Declaration: At the time of filing or revising the declaration in FORM GST TRAN-1/TRAN-2, The applicant is also required to upload on the common portal the pdf copy of a declaration in the format as given in Annexure ‘A’ of the circular.

- Uploading of TRAN-3 in pdf form: The applicant claiming credit in table 7A of FORM GST TRAN-1 on the basis of Credit Transfer Document (CTD) is also required to upload on the common portal the pdf copy of TRANS-3, containing the details in terms of the Notification No. 21/2017-CE (NT) dated 30.06.2017

- No ITC available in respect of Statutory Forms issue after 27.12.2017: No claim for transitional credit shall be filed in table 5(b) & 5(c) of FORM GST TRAN-1 in respect of such C-Forms, F-Forms and H/I-Forms which have been issued after the due date prescribed for submitting the declaration in FORM GST TRAN-1 i.e. after 27.12.2017.

- Consolidated TRAN-2 to be filed: In case of TRAN-2, a consolidated claim is required to be filed, rather than filing for the individual tax period. It may be noted that in the column ‘Tax Period’, the last month of the period for which the claim is made is to be mentioned

- Documents to be submitted to Jurisdictional Authority: Applicant is required to submit following documents to the jurisdictional authority after furnishing the online form.

- Self-certified copy of TRAN-1/TRAN-2 duly downloaded from common portal

- Declaration in Annexure-A

- Copy of TRANS-3, wherever applicable

- Other documents in support of their claim

The applicant shall submit above documents within 7 days of filing the declaration in FORM TRAN-1/TRAN-2 on the GSTN portal:

The details as mentioned in Form TRAN-1 shall be shared with the concerned jurisdictional tax officer for review. Once the order has been issued by the jurisdictional tax officer, the ITC shall be credited to taxpayer’s credit ledger.

It may be noted here that in terms of the Supreme Court directions, the department would be required to complete the verification within 90 days.

- One time opportunity to file/revise the form: Option of filing or revising TRAN-1/TRAN-2 on the common portal during the period from 01.10.2022 to 30.11.2022 is a one-time opportunity for the applicant to either file the said forms, if not filed earlier, or to revise the forms earlier filed.

- No modification allowed after clicking submit button: The applicant can edit the details in FORM TRAN-1/ TRAN-2 on the common portal only before clicking the “Submit” button on the portal. The applicant is allowed to modify/edit, add or delete any record in any of the table of the said forms before clicking the “Submit” button. Once “Submit” button is clicked, the form gets frozen, and no further editing of details is allowed. This frozen form would then be required to be filed on the portal using “File” button, with Digital signature certificate (DSC) or an EVC.

- Filing Form is optional: Those registered persons, who had successfully filed TRAN-1/TRAN-2 earlier, and who do not require to make any revision in the same, are not required to file/ revise TRAN-1/TRAN-2 during this period from 01.10.2022 to 30.11.2022.

- Facility is not available for the persons whose claim has already been rejected:

Where credit availed by the registered person on the basis of FORM GST TRAN-1/TRAN-2 filed earlier, has either wholly or partly been rejected by the proper officer, the appropriate remedy in such cases is to prefer an appeal against the said order or to pursue alternative remedies available as per law.

- Facility is not available for the persons whose adjudication/appeal is pending:

Where the adjudication/ appeal proceeding is pending against rejection of transitional credit, the appropriate course would be to pursue the said adjudication/ appeal

2. Points to be taken care while filing TRAN-1/ TRAN-2 forms:

Basis the above discussion, we may conclude that for claiming the credit of transitional period, taxpayers should take care following points:

- It will not be possible for taxpayers to file/revise TRAN forms after the due date, therefore, they should file/revise the claim within stipulated time.

- Before clicking on the “submit” button, taxpayer needs to check whether all the fields in the forms are correctly filed.

Applicant should ensure that all the necessary documents are duly uploaded.

- Applicant should ensure that hardcopy of necessary documents has been submitted to the jurisdictional authority within 7 days of filing the TRAN-1/TRAN-2 forms.

Disclaimer:

The contents of this article are personal views of the author. This write up is for information purposes only and does not constitute an advice or a legal opinion. While preparing this article author has attempted keep full care and accuracy. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up.

Author / PIC is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof