CBIC Simplifies GST Registration Process and Restricts Unnecessary Officer Queries The Central Board of Indirect Taxes & Customs (CBIC) has issued Instruction No. 03/2025-GST dated 17th April 2025, to streamline the process of GST registration and minimize unnecessary queries and document requests by officers. Key points include: Simplified Documentation: Only specified documents listed in FORM […]

New Income Tax Bill Introduced in Lok Sabha New Delhi, February 13, 2025 – The government today introduced the Income Tax Bill 2025, in the Lok Sabha, aiming to bring significant changes to the existing tax framework. Finance Minister Nirmala Sitharaman presented the bill, emphasizing the government’s commitment to simplifying the tax system and promoting […]

Union Cabinet Approves New Income Tax Bill, Set for Lok Sabha Discussion on Monday: Reports New Delhi, Feb 8, 2025 – The Union Cabinet has approved the much-anticipated new Income Tax Bill, paving the way for a major overhaul of the existing tax framework. The bill is expected to be tabled in the Lok Sabha […]

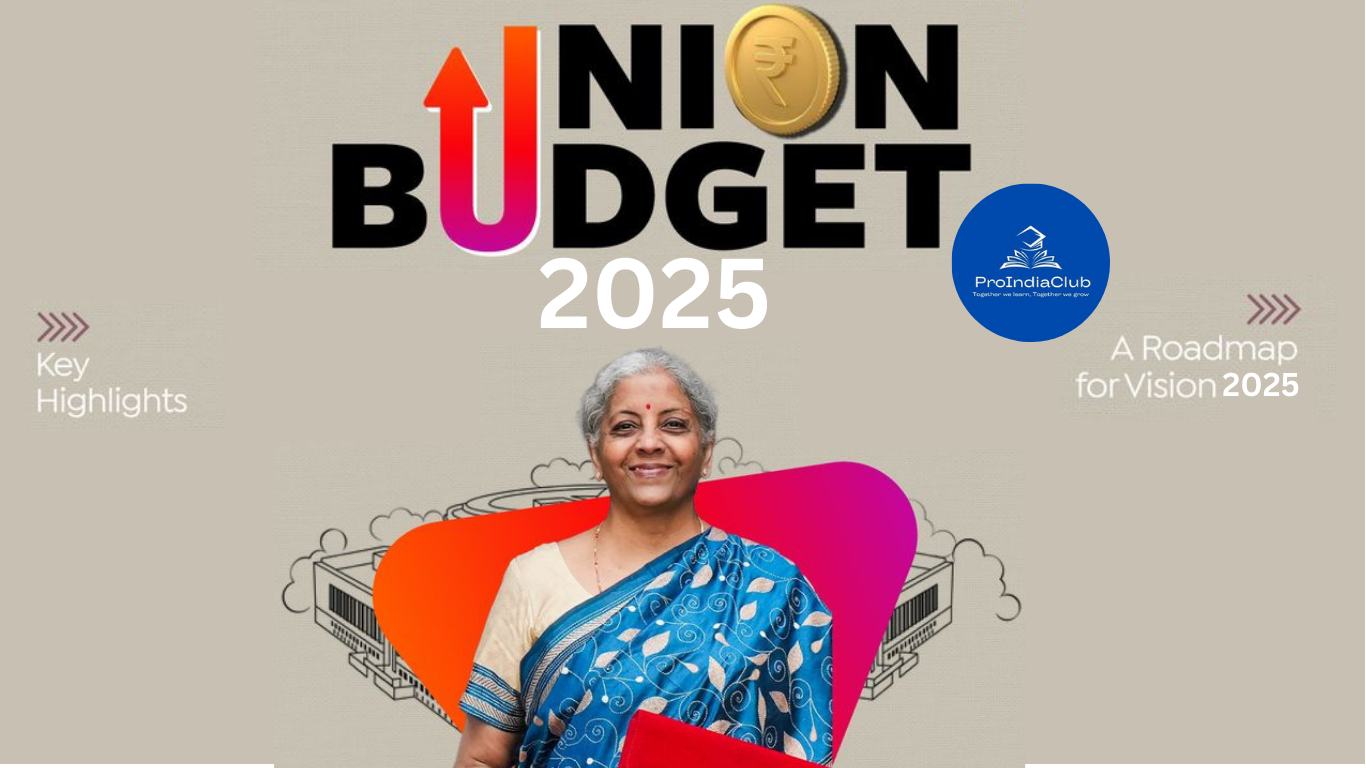

India to Introduce New Income Tax Act, Finance Minister Confirms in Budget 2025 New Delhi, February 1, 2025 — In a landmark announcement during the Union Budget 2025 presentation, Finance Minister Smt. Nirmala Sitharaman confirmed the introduction of a new Income Tax Act, signaling a transformative shift in India’s taxation framework. This reform aims to […]

Key Highlights of Union Budget 2025: Major Reforms in Taxation, MSME Growth, and Export Promotion The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, introduces several key reforms aimed at stimulating economic growth and enhancing the ease of doing business in India. Export Promotion Measures: Duty-Free Inputs for Handicraft and Leather Sectors: To support […]

Opportunity for Taxpayers to Correct Discrepancies in GSTR-3B GSTN provided an opportunity for taxpayers to correct discrepancies in GSTR-3B vide issuing advisory dated 09.04.2024 on Reset and Re-filing of GSTR-3B of some taxpayers. The advisory issued by GSTN is provided below for the taxpayers: Dear Taxpayers, 1. This has reference to the facility for re-filing of […]

Haryana Excise and Taxation Department issued ROD (Removal of Difficulty Order) on OTS-2023 The Excise and Taxation Department, Haryana has announced “The Haryana One Time Settlement Scheme for Recovery of Outstanding Dues, 2023” vide Notification No. No. 71/ST-1 dated 30/12/2023 which was applicable from 01/01/2024. Now, in continuation of that scheme government has issued Removal […]

For recovery of tax and settlement of disputes relating to various taxes levied in Haryana, TheExcise and Taxation Department, Haryana has announced “The Haryana One Time Settlement Scheme for Recovery of Outstanding Dues, 2023” vide Notification No. No. 71/ST-1 dated 30/12/2023 which was applicable from 01/01/2024.

Budget 2024 : GST Updates Amidst the backdrop of upcoming elections, the anticipation is amplified, with businesses and the general public eagerly awaiting the unveiling of financial strategies and initiatives. Led by the capable hands of Finance Minister Smt. Nirmala Sitharaman, the Interim Budget for this year brings forth a wave of expectations and potential […]

Haryana Govt. Introduced One Time Settlement Scheme providing opportunity to settle Pre-GST tax liabilities: Haryana Govt. on December 31, 2023 launched the One Time Settlement-2023 (OTS) Scheme through the Excise and Taxation Department. The scheme will be operational from January 1, 2024, to March 30, 2024. As per the scheme businesses have the opportunity to […]